ONLINE Dan Fulleton Farm Equipment Retirement Auction

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Published 3:30 pm Monday, March 13, 2023

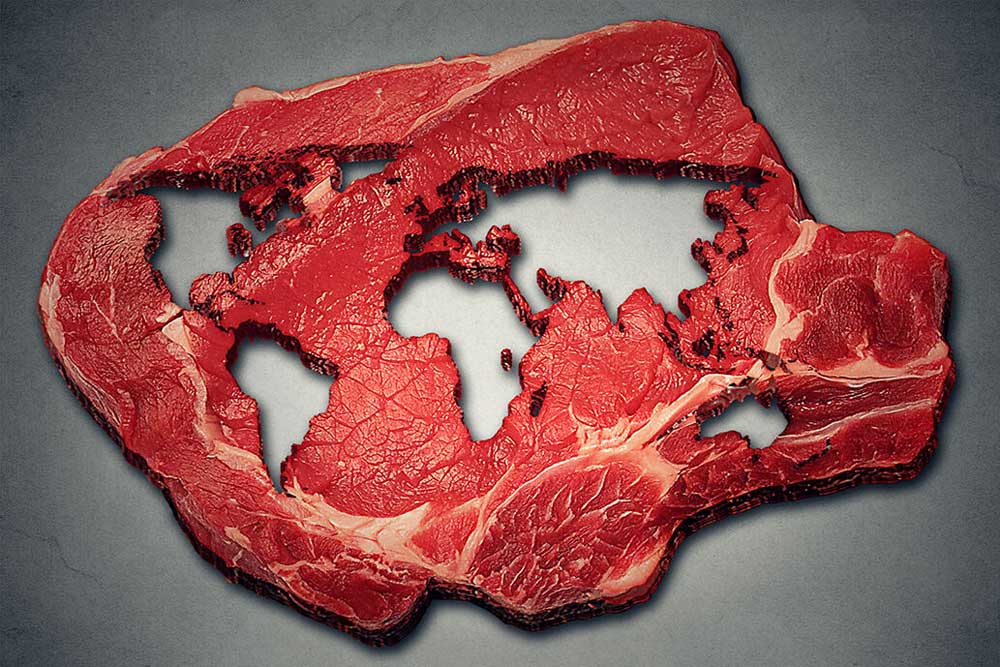

U.S. beef exports fell 15% in volume and 32% in value in January year over year, while pork exports climbed 13% in volume and 16% in value, according to the U.S. Meat Export Federation.

Beef exports declined to several major destinations in January, including South Korea — the top volume market for U.S. beef exports. Exports to that country were down 36% in volume and 52% in value.

They were also down 2% in volume and 20% in value to Japan, the top value market for U.S. beef exports. Shipments were also down 24% in volume and 35% in value to Hong Kong/China, another top market.

Shipments increased sharply to Mexico, the Dominican Republic, the Philippines and Africa. January volume fell nearly 18,000 metric tons year over year to 100,942 metric tons. The value of those exports declined by more than $323 million to $702.3 million.

Beef inventories swelled in some key markets near the end of last year, contributing to a challenging environment for U.S. exports, USMEF reported.

“While beef exports are off to a slow start in 2023, we remain optimistic that post-COVID foodservice demand will strengthen in additional markets as the year progresses,” said Dan Halstrom, USMEF president and CEO.

U.S. pork exports, which posted a strong finish in 2022, maintained their momentum in January, when pork exports were up nearly 28 million metric tons year over year to 236,767 metric tons, and their value increased nearly $88 million to $643.4 million.

“Exports to Mexico, which finished 2022 on a remarkable run on the way to an annual record, set another volume record in January,” USMEF reported.

Fresh off a record year, pork exports to Mexico — the top market for U.S. pork exports — in January were a record 96,800 metric tons, up 11% from a year ago and 7% above the previous high in December 2022. January export value to Mexico soared 40% year over year to $191.2 million.

Mexican demand for U.S. pork is surging even as it faces increasing competition in Mexico, due to suspension of import duties for all eligible suppliers through the end of 2023. Mexico also recently opened to some imports from Brazil, according to USMEF.

Pork exports also trended significantly higher year-over-year to China/Hong Kong, Japan, Canada, the Dominican Republic, Colombia, Honduras and the ASEAN region.

“While Mexico is certainly the pacesetter for U.S. pork exports, it’s encouraging to see such broad-based growth,” Halstrom said.

“Market diversification is always a point of emphasis for the U.S. industry, and it’s more important than ever to find new opportunities for U.S. pork in both established and emerging markets,” he said.

Pork exports to Hong Kong/China — the second-largest market for U.S. pork — were up 31% in volume in January over low year-ago volume and up 24% in value.

Chinese demand is expected to strengthen somewhat in 2023 as importers and consumers respond to the recent removal of COVID-related restrictions and the central and provincial governments implement efforts to revive the economy, according to USMEF.

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Featuring quality surplus farm and dairy equipment from farming operations and dealers across Western, WA. Highlights include sellers from Lynden to Snohomish featuring equipment from Farmers Equipment, Inc., Cleave Farms, […]

Bid Now! Bidding Ends March 12, 10 AM MST Dairy, farm, excavation & heavy equipment, transportation, tools, & more! Register Now! Magic Valley Auction www.MVAidaho.com 208-536-5000

Treasure Valley Livestock Auction Caldwell, Idaho Free Delivery within 400 Miles February 25th, 2025 @ 1PM MST VIEW/BID LIVE ON THE INTERNET: LiveAuctions.TV Find us on Facebook at: Idaho Salers Association Contact Luke Lowe, President Home: 208-924-5106 • Cell: 208-791-7628

The in-person and virtual conference will feature more than 90 speakers, as well as presentations, panel discussions and networking. Organic Seed Alliance (OSA), along with partner Oregon State University’s Center […]

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Range-Raised • Feedlot-Tested • Carcass-Measured • DNA Evaluated Price Cattle Company with Murdock Cattle Co February 26 Lunch Served At 11:00 AM • Sale Starts 1:00 PM 50 Registered Angus Bulls • 60+ SimAngus Bulls 40+ Red Angus Bulls From Murdock Cattle Co. 35 Select Angus and SimAngus Replacement Heifers 10 Elite Red Angus Heifers […]

The event features research updates and educational presentations.

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Moving Back Home! In addition to our yearling bulls, we also added some age-advantage bulls. The sale will take place at the Lewiston Roundup Grounds, just South of Lewiston. Both DVAuction and LiveAuction.tv will be broadcasting live in case you are unable to be with us in person, and the cattle will be on premises […]

FRIDAY – February 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – February 28th, 2025 @ 8:30 AM – (PST) Live-online […]

Trinity Farms BETTER BULLS. BRIGHTER FUTURES. Trinity composite bulls, the perfect solution for advanced beef production. 250 Bulls Available Ellensburg, WA • 3.1.2025 www.trinityfarms.info • (509) 201-0775

Preview: Sat. March 1st 9am - 1 pm Biddings Ends: Thurs. March 6th Starting at 6pm Highlights Include: Bulb planter and harvest equipment, disks, plows, harrows, cultipackers, 4 row planter, […]

Heavy Equipment • Tractors • Construction • Farm Equipment • Vehicles • Trucks • Trailers & More! Virtual Online-Only Auction Full Catalog & Bidding Procedures Available at www.yarbro.com Start […]

Booker's Annual Early Spring Eltopia Auction March 6-7, 2025 www.BookerAuction.com | 509.297.9292

2-Day Online Equipment Auction @ Meridian Equipment Auction CO, Bellingham WA. Now Accepting Quality Machinery Consignments AUCTION INFORMATION Online Only Bidding ONLINE BIDDING OPENS: Feb 22, 2025 DAY 1- Online […]

Oregon State University Surplus hosts Annual Farm Sale Bid on 30+ years of local farm surplus! Join OSU Surplus on March 8th at the Lewis Brown Farm in Corvallis for the […]

Join us for the Genetic Edge Bull Sale! 320 Coming Two-Year-Old Bulls • 265 Yearling Bulls • 305 Calving-Ease Bulls Schedule of Events Friday, March 7, 2025 All Day […]

Online Auction - March 12th Bid Now! Dairy, Farm, Excavation & Heavy Equipment, Transportation, Tools, & More! Magic Valley Auction MVAidaho.com 208-536-5000

March Online Equipment Consignment Auction Online Bidding is Wed, March 12th - Wed, March 19th Chehalis Livestock Market 328 Hamilton Rd. N., Chehalis, WA 98532 Follow Us on Facebook! @Chehalis […]

ONLINE ONLY AUCTION Schritter Farms Retirement Auction Bidding Now Open! Bids Begin Closing on March 12th @ 9AM MST Multiple Locations - Please See Individual Lots For Their Specific Location, […]

Thursday, March 13th at 9:30 AM Rubber Tired Loaders, Crawler Tractors, Cranes, Motor Graders, Haul Trucks, Excavators, Water Trucks, Truck Tractors, Trailers, Attachments and Support Equipment Carlin (Elko), Nevada HIGHLIGHTS: […]

RAM RIDGE LLC & PALM CONSTRUCTION - ONLINE AUCTION Aggregate Crushing & Heavy Equipment Start Date: 10AM | Thursday - March 13 End Date: 10AM | Thursday - March 20 […]

Thursday, March 13th at 9:30 AM ~ Bill Miller Rentals ~ Rubbered Tired Loaders, Crawler Tractors, Cranes, Motor Graders, Haul Trucks, Excavators, Water Trucks, Truck Tractors, Trailers, Attachments and Support […]

March 14th - March 18th 2025 Changes Farm Operations Maxwell, CA Learn more at AUCTION-IS-ACTION.COM Putnam Auctioneers, Inc. CA Bond No. 7238559 Email: putman.kevin@yahoo.com John Putnam - (530) 710-8596 Kevin […]

Saturday, March 15th 9:30 AM Address: 1800 West Bonanza Rd., Las Vegas, NV 89106 Highlights: 2-Tele. Forklifts: Unused JLG 943, Unused JLG 742, 2-Cab & Chassis: (2)Unused Chevy 5500, 3-Detachable […]

March Online Auction Begins to close @3pm MST | March 17, 2025 Early Listings: *2017 Bobcat 418-A-A Mini Excavator, *International 544 Utility Tractor with Loader, *2016 Bobcat E20 Mini Excavator, […]

Multi-Seller - Open Consignment Bidding Now Open - Additional Items Arriving Daily Starts Closing: Tuesday, March 18th @ 2PM (MT) Tractors • Trucks • Trailers • Construction Equipment • Farm […]

Machinery Auction March 19-21 All lots start to close at 8:00 a.m. PST Online Bidding Opens March 14 at 3:00 p.m. PST Items include: Construction Equipment, ATVs, Farm […]

12:30PM Wednesday, March 19, 2025 Performance Tested Bulls: Angus, Simmental and SimAngus, Red Angus, Charolais 90 Day Breeding Guarantee. Western Breeders Assoc. Bonina Feed and Sale Facility, 430 Ferguson Lane, […]

Booker's Annual Early Spring Offsite Farm Auction Ends March 19, 2025 www.BookerAuction.com | 509.297.9292

MAJOR CONSIGNORS: Twin Falls Highway District; KWS Seeds; Molyneux Family Farms; and Sev'rl Area Farmers throughout the Magic Valley NOTICE: Items listing in this auction are located at multiple locations […]

Saturday, March 22, 2025 • At the Ranch • Sandpoint, ID High maternal easy fleshing Cows Low maintenance Heifers High performance Bulls Selling 47 Bulls and 40 Open Heifers […]

Live Streaming Auction - March 26, 2025 Timed Auction (Online Only!) - March 27th, 2025 View Catalogs: Day 1 | Day 2

FRIDAY – March 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – March 28th, 2025 @ 8:30 AM – (PST) Live-online […]