ONLINE Dan Fulleton Farm Equipment Retirement Auction

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Published 9:30 am Thursday, February 13, 2020

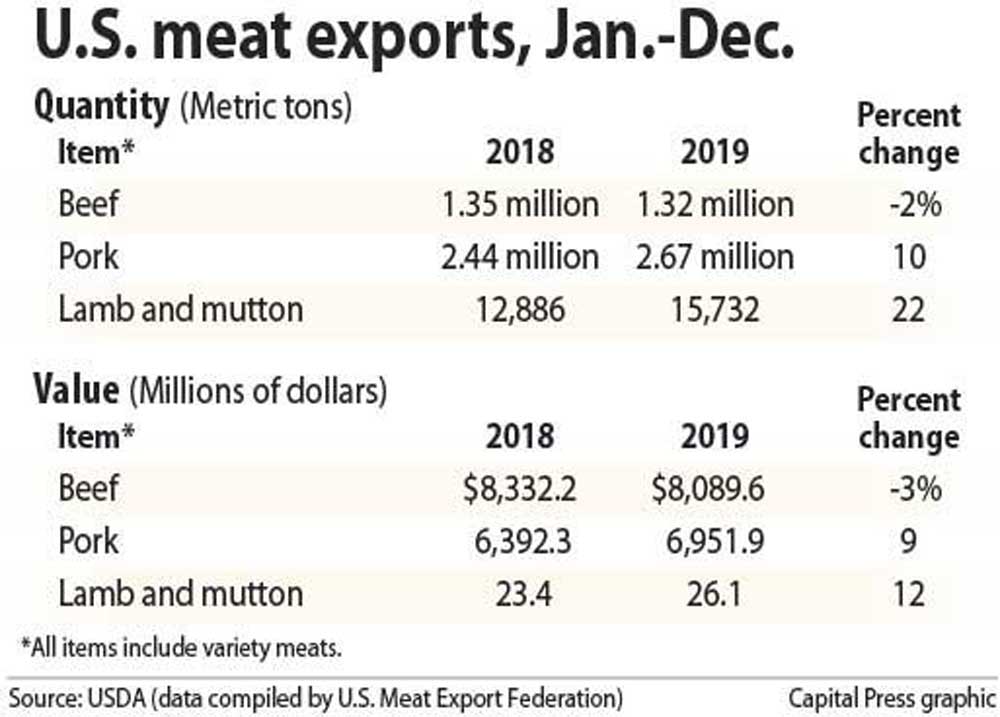

U.S. pork and lamb exports made a good showing in 2019, while beef exports took a step back from 2018’s record levels.

Pork exports, at nearly $7 billion, were up 9% in value and 10% in volume year over year.

While beef exports again topped $8 billion, they declined 3% in value and 2% in volume.

Lamb exports increased 12% in value and 22% in volume.

Combined, total U.S. meat exports were up 5.4% in volume and 2.2% in value in 2019 year over year, according to USDA data compiled by the U.S. Meat Export Federation.

A good end to the year in pork trade pushed 2019 exports beyond 2017’s record level in volume and 2014’s record level in value, according to USMEF.

Pork exports in December were up 34% in volume year over year and 44% in value, breaking volume and value records set in November.

U.S. pork exports to China and Hong Kong put in a record performance in November and climbed even higher in December, up 347% in volume and 308% in value year over year.

“Despite retaliatory duties and other barriers U.S. pork faces in China, exports to the China/Hong Kong region closed 2019 with tremendous momentum,” Dan Halstrom, USMEF president and CEO, said in a press release accompanying the data.

For all of 2019, U.S. pork exports to the region were up 89% in volume and 71% in value.

“We look forward to continued success in 2020, especially if U.S.-China trade relations continue to trend in a positive direction,” he said.

The coronavirus outbreak in China is concerning and disruptive, but it hasn’t changed USMEF’s enthusiasm for meat trade in the region, he said.

U.S. pork exports to Mexico also closed on a positive note with December exports up 10% in volume and 46% in value year over year. The country’s retaliatory tariffs on U.S. pork in the first five months of 2019, however, caused an annual decline of 9% in volume and 2% in value.

U.S. pork exports to leading value market Japan were down 6% in both value and volume in 2019. Much of the decline was in seasoned ground pork due to a wide tariff rate disadvantage compared with European and Canadian product, USMEF reported.

U.S. pork saw significant gains in South America, Central America and Oceania and notable gains in Canada in 2019.

Pork exports represented 26.9% of total U.S. pork production in 2019.

On the beef front, the decline in U.S. exports was partially due to lower shipment to Japan — down 6% in both volume and value in 2019.

But USMEF looks for solid growth in 2020 with the new U.S.-Japan trade agreement, which lowered tariff rates on U.S. beef and pork on Jan. 1 and reduces them further on April 1.

“Buyers in Japan have been waiting a very long time for tariff relief and have already responded enthusiastically,” Halstrom said.

In other top markets for U.S. beef, South Korea’s imports of U.S. beef were up 7% in volume and 5% in value. U.S. beef exports to Mexico were up 5% in value but down 1% in volume. Exports to Hong Kong and China were down 21% in volume and 19% in value due to retaliatory tariffs and other restrictions, USMEF reported.

Beef exports represented 14.1% of total U.S. beef production in 2019.

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Featuring quality surplus farm and dairy equipment from farming operations and dealers across Western, WA. Highlights include sellers from Lynden to Snohomish featuring equipment from Farmers Equipment, Inc., Cleave Farms, […]

Bid Now! Bidding Ends March 12, 10 AM MST Dairy, farm, excavation & heavy equipment, transportation, tools, & more! Register Now! Magic Valley Auction www.MVAidaho.com 208-536-5000

Treasure Valley Livestock Auction Caldwell, Idaho Free Delivery within 400 Miles February 25th, 2025 @ 1PM MST VIEW/BID LIVE ON THE INTERNET: LiveAuctions.TV Find us on Facebook at: Idaho […]

The in-person and virtual conference will feature more than 90 speakers, as well as presentations, panel discussions and networking. Organic Seed Alliance (OSA), along with partner Oregon State University’s Center […]

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Range-Raised • Feedlot-Tested • Carcass-Measured • DNA Evaluated Price Cattle Company with Murdock Cattle Co February 26 Lunch Served At 11:00 AM • Sale Starts 1:00 PM 50 Registered Angus […]

The event features research updates and educational presentations.

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Moving Back Home! In addition to our yearling bulls, we also added some age-advantage bulls. The sale will take place at the Lewiston Roundup Grounds, just South of Lewiston. Both […]

FRIDAY – February 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – February 28th, 2025 @ 8:30 AM – (PST) Live-online […]

Trinity Farms BETTER BULLS. BRIGHTER FUTURES. Trinity composite bulls, the perfect solution for advanced beef production. 250 Bulls Available Ellensburg, WA • 3.1.2025 www.trinityfarms.info • (509) 201-0775

Preview: Sat. March 1st 9am - 1 pm Biddings Ends: Thurs. March 6th Starting at 6pm Highlights Include: Bulb planter and harvest equipment, disks, plows, harrows, cultipackers, 4 row planter, […]

Heavy Equipment • Tractors • Construction • Farm Equipment • Vehicles • Trucks • Trailers & More! Virtual Online-Only Auction Full Catalog & Bidding Procedures Available at www.yarbro.com Start […]

Booker's Annual Early Spring Eltopia Auction March 6-7, 2025 www.BookerAuction.com | 509.297.9292

2-Day Online Equipment Auction @ Meridian Equipment Auction CO, Bellingham WA. Now Accepting Quality Machinery Consignments AUCTION INFORMATION Online Only Bidding ONLINE BIDDING OPENS: Feb 22, 2025 DAY 1- Online […]

Oregon State University Surplus hosts Annual Farm Sale Bid on 30+ years of local farm surplus! Join OSU Surplus on March 8th at the Lewis Brown Farm in Corvallis for the […]

Join us for the Genetic Edge Bull Sale! 320 Coming Two-Year-Old Bulls • 265 Yearling Bulls • 305 Calving-Ease Bulls Schedule of Events Friday, March 7, 2025 All Day […]

Online Auction - March 12th Bid Now! Dairy, Farm, Excavation & Heavy Equipment, Transportation, Tools, & More! Magic Valley Auction MVAidaho.com 208-536-5000

March Online Equipment Consignment Auction Online Bidding is Wed, March 12th - Wed, March 19th Chehalis Livestock Market 328 Hamilton Rd. N., Chehalis, WA 98532 Follow Us on Facebook! @Chehalis […]

ONLINE ONLY AUCTION Schritter Farms Retirement Auction Bidding Now Open! Bids Begin Closing on March 12th @ 9AM MST Multiple Locations - Please See Individual Lots For Their Specific Location, […]

RAM RIDGE LLC & PALM CONSTRUCTION - ONLINE AUCTION Aggregate Crushing & Heavy Equipment Start Date: 10AM | Thursday - March 13 End Date: 10AM | Thursday - March 20 […]

March 14th - March 18th 2025 Changes Farm Operations Maxwell, CA Learn more at AUCTION-IS-ACTION.COM Putnam Auctioneers, Inc. CA Bond No. 7238559 Email: putman.kevin@yahoo.com John Putnam - (530) 710-8596 Kevin […]

Saturday, March 15th 9:30 AM Construction Equipment & Utility Equipment, Aerial Lifts, Boom & Scissor Lifts, Forklifts, Attachments, New Trailers, Trucks Las Vegas, Nevada (Ahern's Main Yard) HIGHLIGHTS: 2-Telescopic Forklifts: […]

Machinery Auction March 19-21 All lots start to close at 8:00 a.m. PST Online Bidding Opens March 14 at 3:00 p.m. PST Items include: Construction Equipment, ATVs, Farm […]

12:30PM Wednesday, March 19, 2025 Performance Tested Bulls: Angus, Simmental and SimAngus, Red Angus, Charolais 90 Day Breeding Guarantee. Western Breeders Assoc. Bonina Feed and Sale Facility, 430 Ferguson Lane, […]

Live Streaming Auction - March 26, 2025 Timed Auction (Online Only!) - March 27th, 2025 View Catalogs: Day 1 | Day 2

FRIDAY – March 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – March 28th, 2025 @ 8:30 AM – (PST) Live-online […]