ONLINE Dan Fulleton Farm Equipment Retirement Auction

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Published 2:00 pm Monday, April 12, 2021

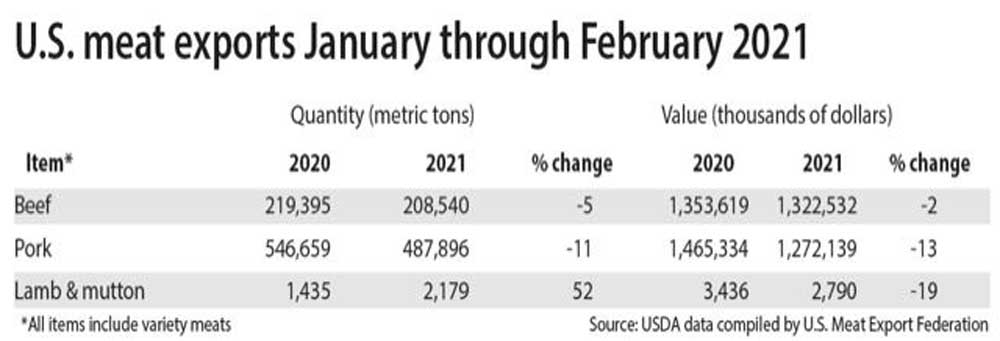

February exports of U.S. beef and pork remained below the rapid pace set in early 2020 but were consistent with projections by the U.S. Meat Export Federation.

Despite the year-over-year decline, the federation expects 2021 beef exports to increase substantially, while pork exports are projected to narrowly surpass the 2020 record.

Beef exports in February totaled 103,493 metric tons at a value of $669.5 million. Those exports were down 8% in volume year over year and 2% in value, due mainly to a decline in variety meat exports.

Through February, beef exports year to date were down 5% in volume and 2% in value from a year earlier.

Beef exports to South Korea are off to a strong start in 2021, up 9% in volume and 10% in value. In addition, demand for U.S. beef continues to grow in China, capitalizing on access gains achieved in the U.S.-China Phase One agreement, the federation reported.

Exports to China in January and February, at 16,982 metric tons, were up 1,072% in volume and, at $124.1 million, were up 1,097% in value from the same period in 2020.

“With Phase One making beef from a much larger percentage of U.S. cattle eligible for China, USMEF expect China to move into the top five destinations for U.S. beef exports in 2021,” Joe Schuele, the federation’s vice president of communications, said.

“In future years, China will likely join Japan and South Korea in the top tier of beef export markets,” he said.

On the pork side, February exports were down 12% from a year earlier at 239,240 metric tons and down 13% in value to $629.4 million.

However, February pork exports set records in the Dominican Republic, Guatemala, El Salvador and Costa Rica and contributed to a 37.7% increase in volume and a 33.9% increase in value of exports to Central America in February. Pork exports were also very strong to the Philippines and Colombia.

As anticipated, February pork exports to China trended lower than the enormous volumes shipped in 2020, down 28.2% in volume and 35.6% in value year over year. But the region continues to be the largest destination for U.S. pork.

While down from 2020, pork exports to the region in 2021 will be the second largest on record, Schuele said,

“Phase One has helped ensure that more U.S. processing plants are eligible to export to China, and with fewer product restrictions,” he said.

U.S. lamb exports in February increased 142% in volume year over year to 1,152 metric tons and 19% in value to $1.6 million. Those increases were fueled by larger variety meat shipments to Mexico, Canada and Hong Kong.

“While February exports were in line with expectations, the results don’t fully reflect global demand for U.S. red meat,” Dan Halstrom, USMEF president and CEO, said in a press release accompanying the data.

“Logistical challenges, including congestion at some U.S. ports, are still a significant headwind and tight labor supplies at the plant level continue to impact export volumes for certain products — including some variety meat items and labor-intensive muscle cuts,” he said.

The flow of exports through U.S. ports is showing some gradual improvement as COVID-impacted crews move closer to full strength, but they remains a serious concern for the U.S. agricultural sector, he said.

Export demand has remained solid despite logistical challenges and other pandemic-related obstacles. Continued international demand, along with robust domestic business, contributed to stronger cutout values in the first quarter, which were up an average of 27% year-over-year for pork and 4% for Choice beef, the federation reported.