ONLINE Dan Fulleton Farm Equipment Retirement Auction

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Published 12:27 pm Friday, January 19, 2024

PORTLAND — The cider world — at least those who braved last week’s ice storm — came to Portland for CiderCon last week.

The theme of the American Cider Association’s conference and business expo was “Connecting to Consumers in an Age of Endless Choice.”

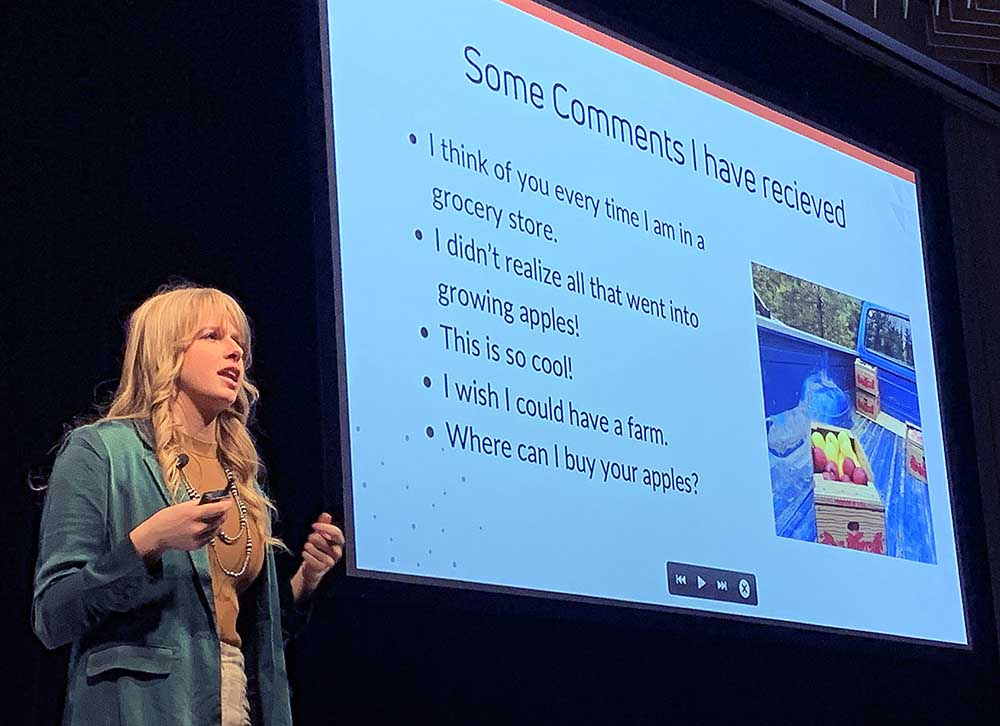

Keynote speakers Jan. 18 stressed storytelling to resonate with consumers.

Kait Thornton, a fourth-generation orchardist from Tonasket, Wash., and a recent Washington State University graduate, has about 500,000 social media followers.

She posts online to combat negativity and share about the farming industry, giving people a reason not just to buy fruit, but to support families.

“Think about your why. … Think about hard experiences. Think about joys,” Thornton said.

“Tell your story, even if you think it’s boring,” she said, because others will be keenly interested and social media is a powerful tool.

Randy Kiyokawa of Parkdale, Ore., who grows 150 varieties of apples, and a dozen purely for cider, told producers to consider what sets them apart.

“Let’s embrace the era of endless choice as an opportunity to connect more deeply,” Kiyokawa said.

Lara Worm, co-founder and CEO of Bivouac Ciderworks in San Diego, said a story is part of every great product.

Her cider is marketed with an outdoors vibe, with the idea of having a cider after an adventure – or atop a peak.

Cider, she said, had a public relations problem, even though it’s as approachable as beer, as nuanced as wine, and has more potential for growth than either.

Cider is diverse and can be enjoyed casually like beer or paired with food like wine, Worm added.

“There is a cider for every occasion,” she said.

U.S. Rep. Earl Blumenauer, D-Ore., received the ACA’s Apple Advocate Award.

He spearheaded the 2015 Cider Act, which provided tax relief for cider makers.

In a prerecorded video, Blumenauer announced he had introduced the Bubble Tax Modernization Act, which would amend a minor carbonation tax disparity for lower alcohol wine, cider and mead made with fruit.

A tax makes carbonating lower alcohol wine, cider and mead made with fruit cost prohibitive, according to an American Cider Association news release.

Carbonated grape wines have a current tax rate of $1.07 per gallon.

For lower alcohol fruit wine, cider and mead, that’s $3.30 or $3.40 per gallon.

Cider makers said the bill will level the playing field and enable innovation for their businesses.

During a panel discussion on sourcing apples, Kiyokawa told cider makers to communicate early with farmers to secure large guarantees.

“There are a lot of growers that are willing to work with you,” he said.

Andrew Byers, head cider maker and co-owner of Finnriver Farm & Cidery in Chimacum, Wash., grows his own intense cider apples, and encourages farmers he buys from to plant multi-use apples so they have other opportunities.

Pressing at the source can save shipping costs, as juice is easier to transport than bins of apples.

Panelists said sourcing locally reduces costs, provides more flexibility and creates a bioregional brand identity.

“There is terroir in those apples,” said David Blaize, an apple grower from Winchester, Va., and co-owner of Old Town Cidery.

THE RISE OF NW CIDER: Beverages continue to gain momentum

Western Innovators: Tapping into the Rogue Valley’s identity with perry

What’s in a name for new apple? Potentially millions of dollars

Queener Farm’s new owners plan to branch out

Two NW farms named to top 20 apple picking spots in U.S.

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Featuring quality surplus farm and dairy equipment from farming operations and dealers across Western, WA. Highlights include sellers from Lynden to Snohomish featuring equipment from Farmers Equipment, Inc., Cleave Farms, […]

Bid Now! Bidding Ends March 12, 10 AM MST Dairy, farm, excavation & heavy equipment, transportation, tools, & more! Register Now! Magic Valley Auction www.MVAidaho.com 208-536-5000

Treasure Valley Livestock Auction Caldwell, Idaho Free Delivery within 400 Miles February 25th, 2025 @ 1PM MST VIEW/BID LIVE ON THE INTERNET: LiveAuctions.TV Find us on Facebook at: Idaho […]

The in-person and virtual conference will feature more than 90 speakers, as well as presentations, panel discussions and networking. Organic Seed Alliance (OSA), along with partner Oregon State University’s Center […]

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Range-Raised • Feedlot-Tested • Carcass-Measured • DNA Evaluated Price Cattle Company with Murdock Cattle Co February 26 Lunch Served At 11:00 AM • Sale Starts 1:00 PM 50 Registered Angus […]

The event features research updates and educational presentations.

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Moving Back Home! In addition to our yearling bulls, we also added some age-advantage bulls. The sale will take place at the Lewiston Roundup Grounds, just South of Lewiston. Both […]

FRIDAY – February 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – February 28th, 2025 @ 8:30 AM – (PST) Live-online […]

Trinity Farms BETTER BULLS. BRIGHTER FUTURES. Trinity composite bulls, the perfect solution for advanced beef production. 250 Bulls Available Ellensburg, WA • 3.1.2025 www.trinityfarms.info • (509) 201-0775

Preview: Sat. March 1st 9am - 1 pm Biddings Ends: Thurs. March 6th Starting at 6pm Highlights Include: Bulb planter and harvest equipment, disks, plows, harrows, cultipackers, 4 row planter, […]

Heavy Equipment • Tractors • Construction • Farm Equipment • Vehicles • Trucks • Trailers & More! Virtual Online-Only Auction Full Catalog & Bidding Procedures Available at www.yarbro.com Start […]

Booker's Annual Early Spring Eltopia Auction March 6-7, 2025 www.BookerAuction.com | 509.297.9292

2-Day Online Equipment Auction @ Meridian Equipment Auction CO, Bellingham WA. Now Accepting Quality Machinery Consignments AUCTION INFORMATION Online Only Bidding ONLINE BIDDING OPENS: Feb 22, 2025 DAY 1- Online […]

Oregon State University Surplus hosts Annual Farm Sale Bid on 30+ years of local farm surplus! Join OSU Surplus on March 8th at the Lewis Brown Farm in Corvallis for the […]

Join us for the Genetic Edge Bull Sale! 320 Coming Two-Year-Old Bulls • 265 Yearling Bulls • 305 Calving-Ease Bulls Schedule of Events Friday, March 7, 2025 All Day […]

Online Auction - March 12th Bid Now! Dairy, Farm, Excavation & Heavy Equipment, Transportation, Tools, & More! Magic Valley Auction MVAidaho.com 208-536-5000

March Online Equipment Consignment Auction Online Bidding is Wed, March 12th - Wed, March 19th Chehalis Livestock Market 328 Hamilton Rd. N., Chehalis, WA 98532 Follow Us on Facebook! @Chehalis […]

ONLINE ONLY AUCTION Schritter Farms Retirement Auction Bidding Now Open! Bids Begin Closing on March 12th @ 9AM MST Multiple Locations - Please See Individual Lots For Their Specific Location, […]

Thursday, March 13th at 9:30 AM Rubber Tired Loaders, Crawler Tractors, Cranes, Motor Graders, Haul Trucks, Excavators, Water Trucks, Truck Tractors, Trailers, Attachments and Support Equipment Carlin (Elko), Nevada HIGHLIGHTS: […]

RAM RIDGE LLC & PALM CONSTRUCTION - ONLINE AUCTION Aggregate Crushing & Heavy Equipment Start Date: 10AM | Thursday - March 13 End Date: 10AM | Thursday - March 20 […]

Thursday, March 13th at 9:30 AM ~ Bill Miller Rentals ~ Rubbered Tired Loaders, Crawler Tractors, Cranes, Motor Graders, Haul Trucks, Excavators, Water Trucks, Truck Tractors, Trailers, Attachments and Support […]

March 14th - March 18th 2025 Changes Farm Operations Maxwell, CA Learn more at AUCTION-IS-ACTION.COM Putnam Auctioneers, Inc. CA Bond No. 7238559 Email: putman.kevin@yahoo.com John Putnam - (530) 710-8596 Kevin […]

Saturday, March 15th 9:30 AM Address: 1800 West Bonanza Rd., Las Vegas, NV 89106 Highlights: 2-Tele. Forklifts: Unused JLG 943, Unused JLG 742, 2-Cab & Chassis: (2)Unused Chevy 5500, 3-Detachable […]

March Online Auction Begins to close @3pm MST | March 17, 2025 Early Listings: *2017 Bobcat 418-A-A Mini Excavator, *International 544 Utility Tractor with Loader, *2016 Bobcat E20 Mini Excavator, […]

Multi-Seller - Open Consignment Bidding Now Open - Additional Items Arriving Daily Starts Closing: Tuesday, March 18th @ 2PM (MT) Tractors • Trucks • Trailers • Construction Equipment • Farm […]

Machinery Auction March 19-21 All lots start to close at 8:00 a.m. PST Online Bidding Opens March 14 at 3:00 p.m. PST Items include: Construction Equipment, ATVs, Farm […]

12:30PM Wednesday, March 19, 2025 Performance Tested Bulls: Angus, Simmental and SimAngus, Red Angus, Charolais 90 Day Breeding Guarantee. Western Breeders Assoc. Bonina Feed and Sale Facility, 430 Ferguson Lane, […]

Booker's Annual Early Spring Offsite Farm Auction Ends March 19, 2025 www.BookerAuction.com | 509.297.9292

MAJOR CONSIGNORS: Twin Falls Highway District; KWS Seeds; Molyneux Family Farms; and Sev'rl Area Farmers throughout the Magic Valley NOTICE: Items listing in this auction are located at multiple locations […]

Saturday, March 22, 2025 • At the Ranch • Sandpoint, ID High maternal easy fleshing Cows Low maintenance Heifers High performance Bulls Selling 47 Bulls and 40 Open Heifers […]

Live Streaming Auction - March 26, 2025 Timed Auction (Online Only!) - March 27th, 2025 View Catalogs: Day 1 | Day 2

FRIDAY – March 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – March 28th, 2025 @ 8:30 AM – (PST) Live-online […]