ONLINE Dan Fulleton Farm Equipment Retirement Auction

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Published 6:15 pm Friday, December 1, 2023

The Washington Farm Bureau estimates farmers have paid at least $153 million and likely far more this year in cap-and-trade fees, even though lawmakers intended to exempt agriculture from the tax on fossil fuels.

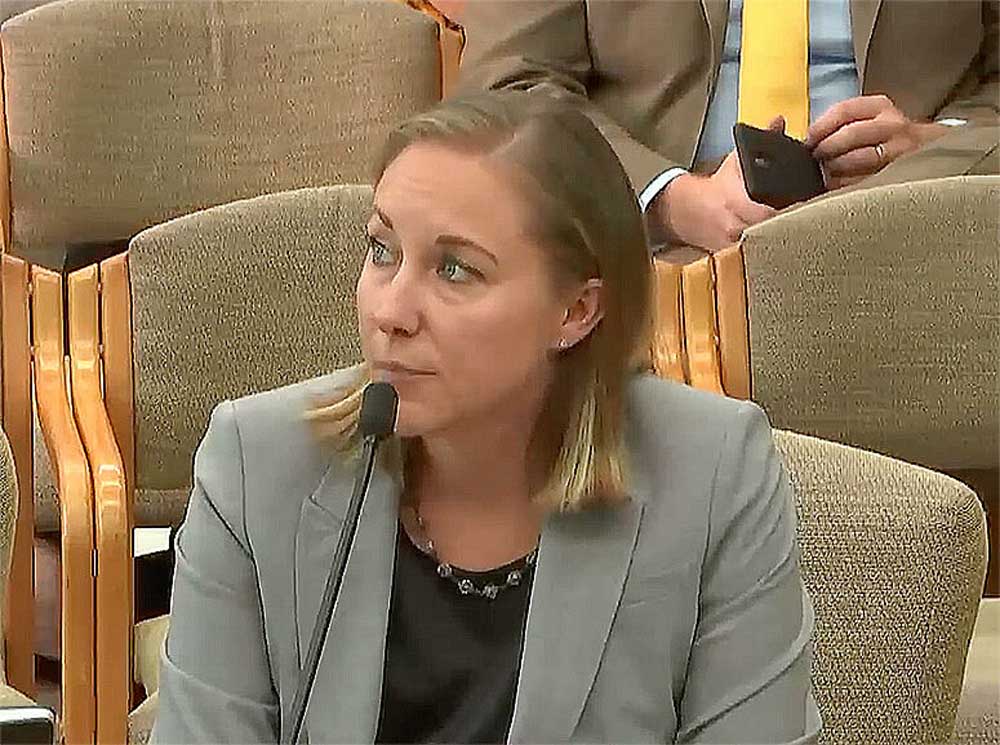

Farm Bureau director of governmental relations Breanne Elsey told the Senate Agriculture and Natural Resources Committee Nov. 30 that refunds to farmers shouldn’t be viewed as costing the state money.

“We hear that if we have a reimbursement program, the state is going to lose money,” she said. “This is money the state will end up with that they never should have had to begin with.”

Lawmakers in 2021 told the state Department of Ecology to devise a method for excluding fuel used for producing and transporting farm goods from cap-and-trade, a hard task because of complicated supply chains linking refineries to retailers.

The program went into effect Jan. 1 without Ecology devising a way. Ecology has resisted reimbursing farmers and has largely left it up to oil companies, fuel distributors and farms to sort out the problem.

The Farm Bureau estimates farmers have paid between $153 million and $172 million in cap-and-trade fees for on-farm fuel. The estimate doesn’t include fuel to truck or barge agricultural products, or some types of fuel such as propane and kerosene.

“I imagine the actual damages are well in excess of $200 million,” Elsey said.

Ecology climate section policy manager Joel Creswell told the committee the department doesn’t have the information to issue refunds. Ecology doesn’t know how much cap-and-trade is costing fuel users, he said.

“We don’t set the (cap-and-trade) surcharges, and we don’t actually collect information on what those surcharges are,” Creswell said.

“The pricing has always been in the direct control of the fuel suppliers. They’re making decisions based on what they’re estimating their compliance costs to be,” he said.

Cap-and-trade taxes carbon emissions, but the tax is not transparent and it changes with every cap-and-trade auction of carbon allowances. The state has collected more than $1.5 billion so far this year.

The law’s design guarantees the public can’t know exactly how the increase in state revenue is affecting pump prices. A fair, but rough, estimate is that it’s adding 50 cents a gallon to gasoline and 62 cents a gallon to diesel.

Cap-and-trade foes have submitted a petition to discard the law. The Secretary of State’s Office is checking whether the citizens’ initiative has enough valid signatures to qualify for the November 2024 ballot.

Creswell said he was optimistic more farmers will be exempt from cap-and-trade fees as fuel distributors and farms work out the problem.

“Everytime we check in on this, we’re hearing that more and more people are getting their refunds,” he said.

Elsey agreed some farms with storage tanks and that have fuel delivered are seeing relief. Farmers who get fuel at retail stations are still paying for cap-and-trade, she said.

“For agriculture, the hard part about this is it disproportionately impacts the smallest farmers in the state,” she said. “So when you hear this is mostly resolved, I say you’re not even close.”

Elsey said in an interview that she hopes lawmakers will develop a bipartisan plan to fix the problem. While some farmers have gotten refunds, others have been left out. “Because there is no program, there is no uniformity,” she said.

THIS WILL BE AN ONLINE AUCTION Visit bakerauction.com for full sale list and information Auction Soft Close: Mon., March 3rd, 2025 @ 12:00pm MT Location: 3550 Fulleton Rd. Vale, OR […]

Featuring quality surplus farm and dairy equipment from farming operations and dealers across Western, WA. Highlights include sellers from Lynden to Snohomish featuring equipment from Farmers Equipment, Inc., Cleave Farms, […]

Bid Now! Bidding Ends March 12, 10 AM MST Dairy, farm, excavation & heavy equipment, transportation, tools, & more! Register Now! Magic Valley Auction www.MVAidaho.com 208-536-5000

Treasure Valley Livestock Auction Caldwell, Idaho Free Delivery within 400 Miles February 25th, 2025 @ 1PM MST VIEW/BID LIVE ON THE INTERNET: LiveAuctions.TV Find us on Facebook at: Idaho […]

The in-person and virtual conference will feature more than 90 speakers, as well as presentations, panel discussions and networking. Organic Seed Alliance (OSA), along with partner Oregon State University’s Center […]

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Range-Raised • Feedlot-Tested • Carcass-Measured • DNA Evaluated Price Cattle Company with Murdock Cattle Co February 26 Lunch Served At 11:00 AM • Sale Starts 1:00 PM 50 Registered Angus […]

The event features research updates and educational presentations.

Live Streaming Auction - February 26, 2025 Timed Auction (Online Only!) - February 27, 2025 View Catalogs: Day 1 | Day 2

Moving Back Home! In addition to our yearling bulls, we also added some age-advantage bulls. The sale will take place at the Lewiston Roundup Grounds, just South of Lewiston. Both […]

FRIDAY – February 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – February 28th, 2025 @ 8:30 AM – (PST) Live-online […]

Trinity Farms BETTER BULLS. BRIGHTER FUTURES. Trinity composite bulls, the perfect solution for advanced beef production. 250 Bulls Available Ellensburg, WA • 3.1.2025 www.trinityfarms.info • (509) 201-0775

Preview: Sat. March 1st 9am - 1 pm Biddings Ends: Thurs. March 6th Starting at 6pm Highlights Include: Bulb planter and harvest equipment, disks, plows, harrows, cultipackers, 4 row planter, […]

Heavy Equipment • Tractors • Construction • Farm Equipment • Vehicles • Trucks • Trailers & More! Virtual Online-Only Auction Full Catalog & Bidding Procedures Available at www.yarbro.com Start […]

Booker's Annual Early Spring Eltopia Auction March 6-7, 2025 www.BookerAuction.com | 509.297.9292

2-Day Online Equipment Auction @ Meridian Equipment Auction CO, Bellingham WA. Now Accepting Quality Machinery Consignments AUCTION INFORMATION Online Only Bidding ONLINE BIDDING OPENS: Feb 22, 2025 DAY 1- Online […]

Oregon State University Surplus hosts Annual Farm Sale Bid on 30+ years of local farm surplus! Join OSU Surplus on March 8th at the Lewis Brown Farm in Corvallis for the […]

Join us for the Genetic Edge Bull Sale! 320 Coming Two-Year-Old Bulls • 265 Yearling Bulls • 305 Calving-Ease Bulls Schedule of Events Friday, March 7, 2025 All Day […]

Online Auction - March 12th Bid Now! Dairy, Farm, Excavation & Heavy Equipment, Transportation, Tools, & More! Magic Valley Auction MVAidaho.com 208-536-5000

March Online Equipment Consignment Auction Online Bidding is Wed, March 12th - Wed, March 19th Chehalis Livestock Market 328 Hamilton Rd. N., Chehalis, WA 98532 Follow Us on Facebook! @Chehalis […]

ONLINE ONLY AUCTION Schritter Farms Retirement Auction Bidding Now Open! Bids Begin Closing on March 12th @ 9AM MST Multiple Locations - Please See Individual Lots For Their Specific Location, […]

Thursday, March 13th at 9:30 AM Rubber Tired Loaders, Crawler Tractors, Cranes, Motor Graders, Haul Trucks, Excavators, Water Trucks, Truck Tractors, Trailers, Attachments and Support Equipment Carlin (Elko), Nevada HIGHLIGHTS: […]

RAM RIDGE LLC & PALM CONSTRUCTION - ONLINE AUCTION Aggregate Crushing & Heavy Equipment Start Date: 10AM | Thursday - March 13 End Date: 10AM | Thursday - March 20 […]

Thursday, March 13th at 9:30 AM ~ Bill Miller Rentals ~ Rubbered Tired Loaders, Crawler Tractors, Cranes, Motor Graders, Haul Trucks, Excavators, Water Trucks, Truck Tractors, Trailers, Attachments and Support […]

March 14th - March 18th 2025 Changes Farm Operations Maxwell, CA Learn more at AUCTION-IS-ACTION.COM Putnam Auctioneers, Inc. CA Bond No. 7238559 Email: putman.kevin@yahoo.com John Putnam - (530) 710-8596 Kevin […]

Saturday, March 15th 9:30 AM Address: 1800 West Bonanza Rd., Las Vegas, NV 89106 Highlights: 2-Tele. Forklifts: Unused JLG 943, Unused JLG 742, 2-Cab & Chassis: (2)Unused Chevy 5500, 3-Detachable […]

March Online Auction Begins to close @3pm MST | March 17, 2025 Early Listings: *2017 Bobcat 418-A-A Mini Excavator, *International 544 Utility Tractor with Loader, *2016 Bobcat E20 Mini Excavator, […]

Multi-Seller - Open Consignment Bidding Now Open - Additional Items Arriving Daily Starts Closing: Tuesday, March 18th @ 2PM (MT) Tractors • Trucks • Trailers • Construction Equipment • Farm […]

Machinery Auction March 19-21 All lots start to close at 8:00 a.m. PST Online Bidding Opens March 14 at 3:00 p.m. PST Items include: Construction Equipment, ATVs, Farm […]

12:30PM Wednesday, March 19, 2025 Performance Tested Bulls: Angus, Simmental and SimAngus, Red Angus, Charolais 90 Day Breeding Guarantee. Western Breeders Assoc. Bonina Feed and Sale Facility, 430 Ferguson Lane, […]

Booker's Annual Early Spring Offsite Farm Auction Ends March 19, 2025 www.BookerAuction.com | 509.297.9292

MAJOR CONSIGNORS: Twin Falls Highway District; KWS Seeds; Molyneux Family Farms; and Sev'rl Area Farmers throughout the Magic Valley NOTICE: Items listing in this auction are located at multiple locations […]

Saturday, March 22, 2025 • At the Ranch • Sandpoint, ID High maternal easy fleshing Cows Low maintenance Heifers High performance Bulls Selling 47 Bulls and 40 Open Heifers […]

Live Streaming Auction - March 26, 2025 Timed Auction (Online Only!) - March 27th, 2025 View Catalogs: Day 1 | Day 2

FRIDAY – March 28, 2025 / 8:30 AM 17129 HIGHWAY 99 NE, WOODBURN, OR 97071 AUCTION DETAILS: Auction Begins: Friday – March 28th, 2025 @ 8:30 AM – (PST) Live-online […]